Video file

الافراد

مهما كانت أحلامك كبيرة… معنا تتحقق.

متطلبات الحياة أصبحت كثيرة، ونحن في عبداللطيف جميل للتمويل سند وعون لك في كل خطوة.

On

حلول الأفراد

تغطي حلول التمويل المنتجات التالية

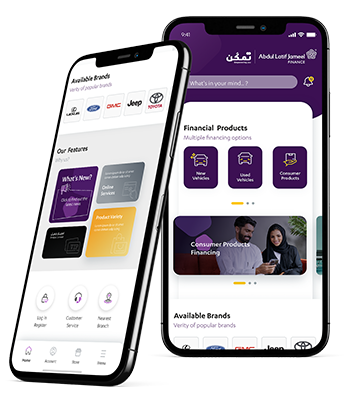

قم بتنزيل تطبيقنا

احصل على التطبيق واكتشف جميع العروض أثناء التنقل

الأفراد

الصورة